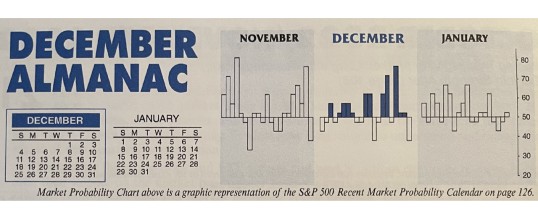

December is the number three S&P 500 and Dow Jones Industrials month since 1950, averaging gains of 1.5% and 1.6% respectively. It’s the second-best Russell 2000 (1979) month and fourth best for NASDAQ (1971). In 2018, DJIA suffered its worst December performance since 1931 and its fourth worst December going all the way back to 1901. However, the market rarely falls precipitously in December and a repeat of 2018 does not seem highly likely this year. When December is down ...

Continue Reading →NOV

2022