Seasonal:

Seasonal:

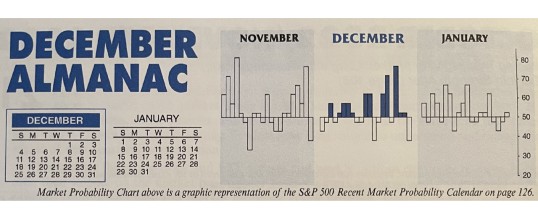

Bullish. December is the #3 month of the year for DJIA and S&P 500 since 1950, #4 NASDAQ month (since 1971). Small-cap outperformance historically begins around mid-December. Watch for the Santa Claus Rally to begin when the market opens on December 22.

Fundamental:

Fundamental:

Improving? ...

Continue Reading →NOV

2022