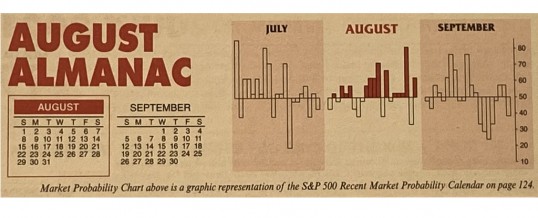

Money flows from harvesting made August a great stock market month in the first half of the Twentieth Century. It was the best month from 1901 to 1951. In 1900, 37.5% of the population was farming. Now that less than 2% farm, August is amongst the worst months of the year. It is the worst DJIA, S&P 500, and Russell 2000 month over the last 33 years, 1988-2020 with average declines ranging from 0.4% by Russell 2000 to 0.8% by ...

Continue Reading →AUG

2021