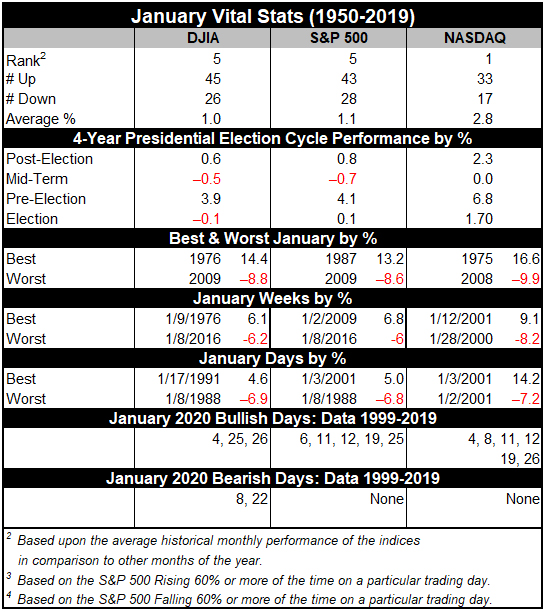

January has quite a reputation on Wall Street as an influx of cash from yearend bonuses and annual allocations has historically propelled stocks higher. January ranks #1 for NASDAQ (since 1971), but fifth on the S&P 500 and sixth for DJIA since 1950. January is the last month of the best three-month span and holds a full docket of indicators and seasonalities.

DJIA and S&P rankings did slip from 2000 to 2016 as both indices suffered losses in ten of those seventeen Januarys with three in a row, 2008, 2009 and 2010 and then again in 2014 to 2016. January 2009 has the dubious honor of being the worst January on record for DJIA (-8.8%) and S&P 500 (-8.6%) since 1901 and 1931 respectively. The early stages of the Covid-19 pandemic mostly spoiled January in 2020 as DJIA, S&P 500, and Russell 2000 all suffered declines. Only NASDAQ was positive.

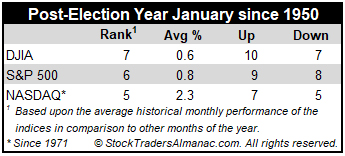

In post-election years, Januarys have been modestly weaker. DJIA and S&P 500 slip to number #7 and #6 respectively but do maintain positive average performance. NASDAQ holds the outright best ranking of the five at 5th place, but the frequency of gains has historically been mixed. DJIA, S&P 500 and NASDAQ have all advanced in seven of the last nine post-election year Januarys. The two down post-election years since 1985 were 2005 and 2009.

On pages 110 and 112 of the Stock Trader’s Almanac 2021 we illustrate that the January Effect, where small caps begin to outperform large caps, actually has started in mid-December. Early signs of the January Effect can be seen when comparing the Russell 2000 index of small cap stocks to the S&P 500 since December 15. Historically, the majority of small-cap outperformance is normally done by mid-February, but strength can last until mid-May when indices typically reach a seasonal high.

The first indicator to register a reading in January is the Santa Claus Rally. The seven-trading day period begins on the open on December 24 and ends with the close of trading on January 5. Normally, the S&P 500 posts an average gain of 1.3%. The failure of stocks to rally during this time has tended to precede bear markets or times when stocks could be purchased at lower prices later in the year.

On January 8, our First Five Days “Early Warning” System will be in. In post-presidential election years this indicator has a solid record. In the last 17 post-presidential election years 13 full years followed the direction of the First Five Days. The full-month January Barometer has a slightly better record in post-presidential election years with 14 of the last 17 full years following January’s direction.

Our flagship indicator, the January Barometer created by Yale Hirsch in 1972, simply states that as the S&P goes in January so goes the year. It came into effect in 1934 after the Twentieth Amendment moved the date that new Congresses convene to the first week of January and Presidential inaugurations to January 20.

The long-term record has been stupendous, an 85.7% accuracy rate, with only ten major errors since 1950. Major errors occurred in the secular bear market years of 1966, 1968, 1982, 2001, 2003, 2009, 2010 and 2014 and again in 2016 as a mini bear came to an end. The tenth major and most recent error was in 2018 as a hawkish Fed continued to hike rates even as economic growth slowed and longer-term interest rates fell. The market’s position on the last trading day of January will give us a better read on the year to come. When all three of these indicators are in agreement it has been prudent to heed their call.

DEC

2020