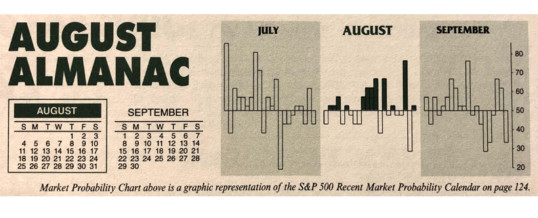

Money flows from harvesting made August a great stock market month in the first half of the Twentieth Century. It was the best month from 1901 to 1951. In 1900, 37.5% of the population was farming. Now that less than 2% farm, August is amongst the worst months of the year. It is the worst DJIA, S&P 500 and NASDAQ month over the last 31 years, 1988-2018 with average declines ranging from 0.1% by NASDAQ to 1.1% by DJIA. In ...

Continue Reading →JUL

2019