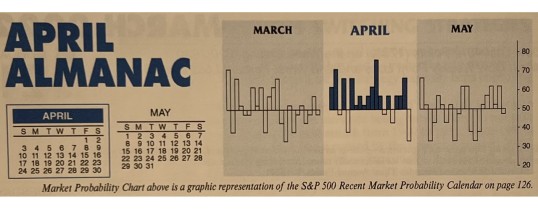

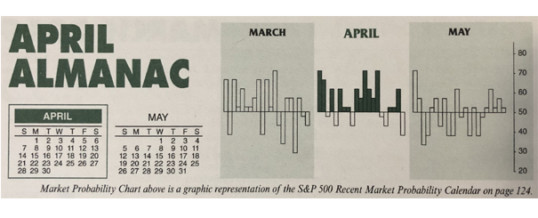

April marks the end of the “Best Six Months” for DJIA and the S&P 500. The window for the Stock Trader’s Almanac Seasonal MACD sell signal opens on April 1st. From the Stock Trader’s Almanac Seasonal MACD Buy Signal on October 8, 2021, through the March 31 close, DJIA is down 0.2% while S&P 500 is up 3.2%. This is below historical average performance due largely to surging inflation, a tightening Fed and Russia’s invasion of Ukraine. But before the ...

Continue Reading →APR

2022