May officially marks the beginning of the “Worst Six Months” for the DJIA and S&P. To wit: “Sell in May and go away.” Our “Best Six Months Switching Strategy,” created in 1986, proves that there is merit to this old trader’s tale. A hypothetical $10,000 investment in the DJIA compounded to a gain of $1,230,865 for November-April in 71 years compared to just $2,693 for May-October (STA 2022, page 54). The same hypothetical $10,000 investment in the S&P 500 compounded to $1,011,918 for November-April in 71 years compared to a gain of just $12,623 for May-October.

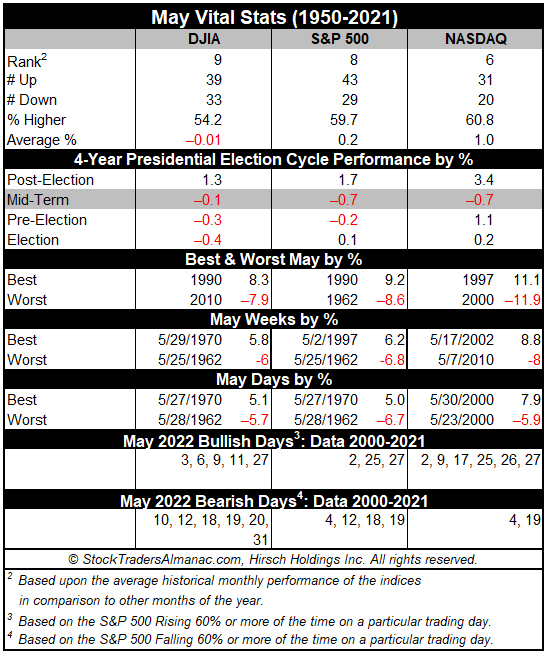

May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 “flash crash”. It used to be part of what we once called the “May/June disaster area.” From 1965 to 1984 the S&P 500 was down during May fifteen out of twenty times. Then from 1985 through 1997 May was the best month, gaining ground every single year (13 straight gains) on the S&P, up 3.3% on average with the DJIA falling once and two NASDAQ losses.

In the years since 1997, May’s performance has been erratic; DJIA up thirteen times in the past twenty-four years (four of the years had gains in excess of 4%). NASDAQ suffered five May losses in a row from 1998-2001, down –11.9% in 2000, followed by thirteen sizable gains in excess of 2.5% and six losses, the worst of which was 8.3% in 2010 followed by another sizable loss of 7.9% in 2019.

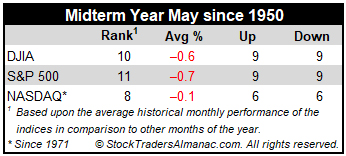

Since 1950, midterm-year Mays rank poorly, #10 DJIA, #11 S&P 500, #8 NASDAQ and #9 Russell 2000. Performance ranges from a best of –0.1% by NASDAQ to a worst of –1.1% for Russell 2000. Not one of these indexes has been positive more than 50% of the time in midterm years.

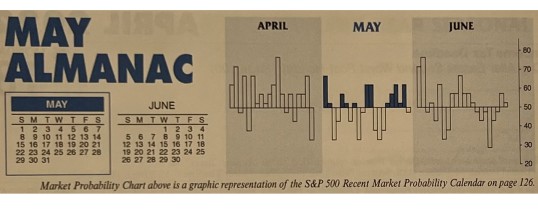

The first two days of May have historically traded higher, and the S&P 500 has been up 17 of the last 24 first trading days of May. Bouts of weakness often appears around or on the third, sixth, and twelfth trading days of the month while the last four or five trading days have generally enjoyed respectable gains on average. In midterm years it has generally been better to lighten up on long positions early in May as the entire month tends to be weak (pages 42 and 44 STA 2022).

MAY

2022