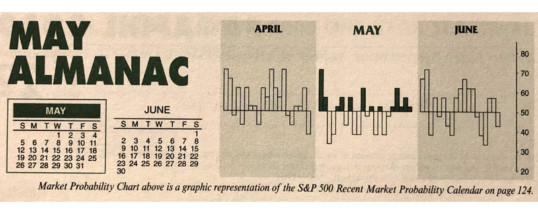

May officially marks the beginning of the “Worst Six Months” for the DJIA and S&P. To wit: “Sell in May and go away.” Our “Best Six Months Switching Strategy,” created in 1986, proves that there is merit to this old trader’s tale. A hypothetical $10,000 investment in the DJIA compounded to a gain of $1,008,519 for November-April in 68 years compared to just $1,031 for May-October. The same hypothetical $10,000 investment in the S&P 500 compounded to $720,389 for November-April ...

Continue Reading →MAY

2019