Seasonal:

Seasonal:

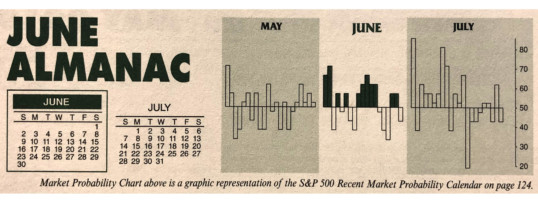

Turning Bearish. July is the best month of the third quarter, but performance in pre-election years has been uninspiring. First half of July likely to be better than second half. NASDAQ’s midyear rally ends on the ninth trading day and July is the beginning of NASDAQ’s “Worst Four Months.”

Continue Reading →

2

Continue Reading →

2

JUL

2019

0

JUL

2019