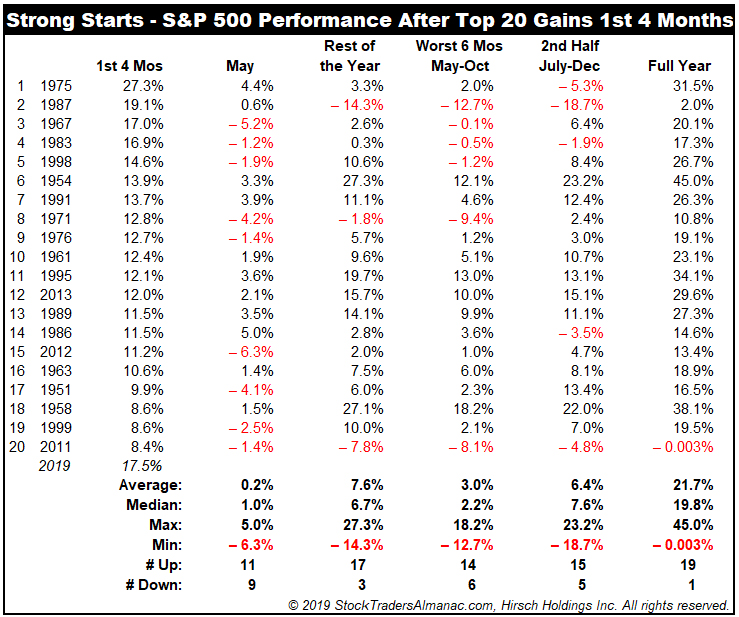

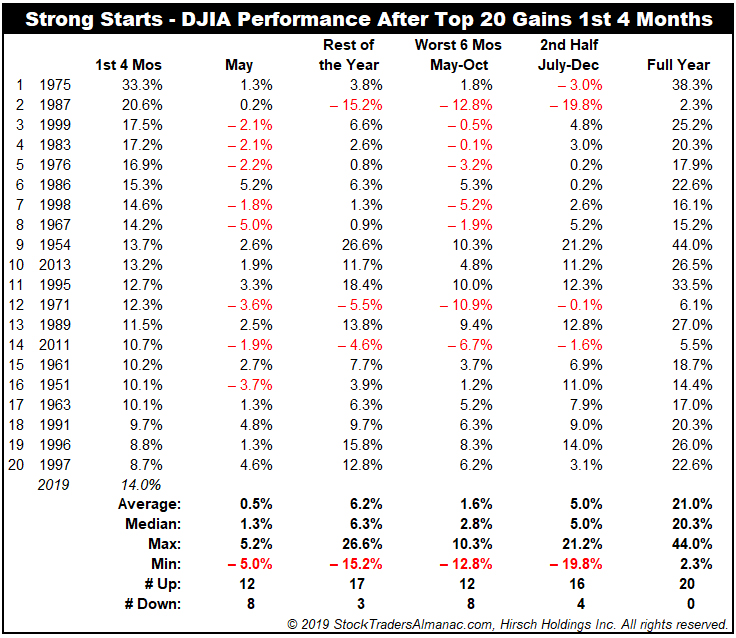

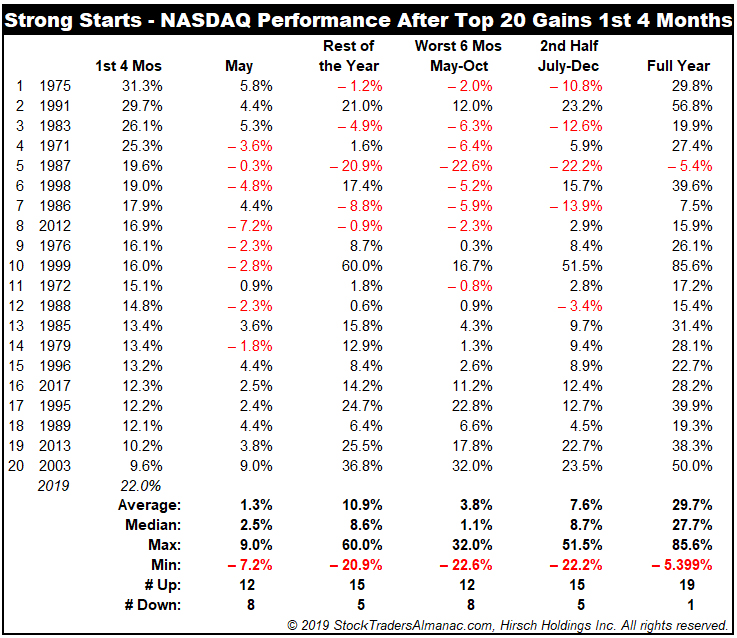

Big gains the first four months of 2019 have some Wall Street pundits and analysts concerned. While strong starts for the market for the first four months of the year don’t leave much for the rest of the year, it is by no means a negative implication or bearish indication. S&P 500 leads the pack with its 17.5% gain coming in at #3 since 1950. NASDAQ’s 22.0% gain is the 5th best first four month since 1971. DJIA’s 14.0% rise is number 9.

In the tables below we have displayed the top 20 first four month gains for the three major U.S. market indices with the subsequent changes for May, Rest of the Year, “Worst Six Months” May-October, 2nd half July-December and full year performance. While most of the full year gains are clearly logged in these big first-four-month gains, there still upside to be had in the latter part of the year.

As you might expect May is weakest for DJIA and S&P and the Worst Six Months are hit hardest mostly after the strongest starts. The major blemish is course in 1987, with other critical givebacks in 1971 and 2011. Other significant issues arose in 1975, 1983, 1986 and 1998. Basically, if you take 1987 out of the equation the rest of the year after strong starts aint so bad. Average gains are about equal to historical average annual gains. Rest of the year gains sans 1987: DJIA 7.3%, S&P 500 8.7%, NASDAQ 12.6%.

MAY

2019