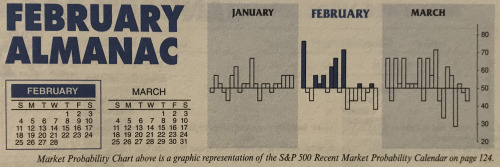

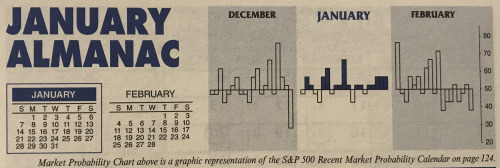

As the market is finally making a rally attempt at the end of April, the last month of the Best Six Months” we are obligated to remind you that the “Worst Six Months” are now upon us, and as we pointed out last month this bearish seasonal stretch has been more pronounced in midterm years.

For the near term over the next several weeks the rally may have some legs. But as we get into the summer doldrums ...

Continue Reading →MAY

2018