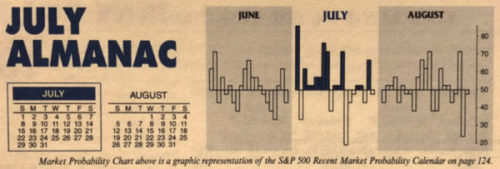

As of today’s close DJIA is up 3.18% thus far in July. S&P 500 is slightly better at 3.26% while Russell 2000 is up 3.37%. NASDAQ is best up 4.41% with another six trading sessions to go in the month. As you can see in the chart below this is well above average historical July performance at this point of the month over the last 21 years. Early month strength (trading days three, four and five) was substantially greater this ...

Continue Reading →JUL

2018