Incoming economic and corporate data readings along with the positive reception to the new tax law on Wall Street and in boardrooms across the country have conspired to keep my more bullish 2018 forecast scenarios from last month on track. Positive readings from the first two legs of my January Indicator Trifecta lend further support to our positive outlook for 2018. However, many have latched onto the notion that due to the fact that the market is off to its best start since 1987, something ominous is on the horizon. Just because the market is up the most this January since 1987, it does not mean we are due for a 1987-style crash.

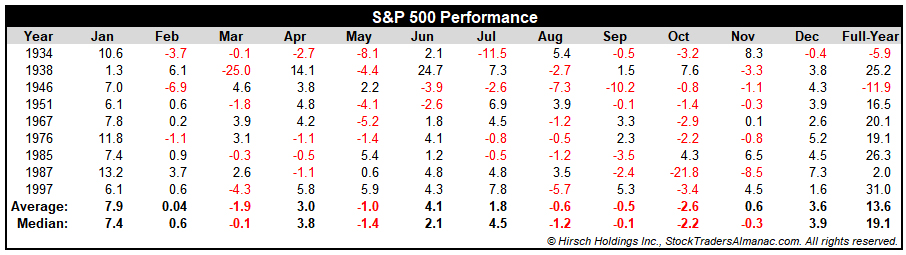

Since December 31 the Dow Jones Industrial Average (DJIA) is up 7.7% in just four weeks and now just 9.0% away from the 29,000 level I said was in the cards for 2018 in my forecast. But we are still a far cry from the 13+% gains we had at this time in 1987 and for the full month of January 1987. In fact, the vast majority of big January gains were followed by great years. As you can see in the table below of the other Top 10 performing Januarys, as measured by the S&P 500 on the fifteenth trading day of the month, six of those nine years posted solid double-digit gains.

So as we sit here in the midst of the Best Six Months following the positive vibrations of great Worst Six Months, improving fundamental data, upbeat corporate guidance, and technical market momentum gives us further conviction that our bullish outlook remains prudent for this year.

Midterm Februarys are more bullish than then usual and March remains strong in midterm years as well. April, May and June are weaker in midterm years, so we suspect this rally to continue higher for a bit more before we run into any meaningful pullback. While we are always on the lookout for cracks in the market’s bullish veneer and prepared to make adjustments to our outlook should any breakdowns in the date suggest the party is over, we don’t expect anything unfavorable until the end of the Best Six Months.

Comments and actions from CEOs have been optimistic, constructive and bullish on how the new tax legislation will fall nicely to their bottom lines. They have already been putting more money in the pockets of their employees and upping earnings outlooks. Some of the praise from bigtime, mainstream business moguls has been unexpectedly lavish.

Spending is up, earnings are forecasted to rise and the economy is gathering momentum. Most impressively the economy is growing more on its own two feet now, healthily digesting the interest rate tightening and the reduction in the Fed’s massive balance sheet. Workers are coming back to the labor force, yet unemployment remains in check and historically low. A bit of healthy inflation is starting to perk up as well.

There has been some concern expressed about high price-earnings (PE) valuations and excessive bullish sentiment. PEs can come down in one of two ways. Stock prices can come down or earnings can rise. From what we have been hearing from CEOs it sounds like they are expecting an increase in earnings. As for contrary bullish sentiment indicators, history has taught us that high bullish sentiment can stay high for quite a while and longer than most bears can stay short and it’s only indicative when it takes a sharp turn lower.

There is also a great deal of cash on the sidelines. BlackRock CEO Larry Fink relates in his recent Davos interview (jump to the minute 4:30-5:30 mark), that as this large amount of cash comes back into this bull market it will provide more momentum. Finally, let’s not forget that the eighth year of decades boasts the second best record next to 5th years in the past thirteen decades with an average 14.5% gain for DJIA, 2008 notwithstanding. So, while we remain rather bullish for the near term and 2018 as a whole, we do expect some mild pullback in the Worst Six Months and remain prudent and ready to make our regular adjustments based on our calendar rules and tactical market signals.

FEB

2018