Seasonal:

Seasonal:

Bullish. January is the third month of the Best Six/Eight, but it is the last of the Best Consecutive Three month span. January is the top month for NASDAQ (since 1971) averaging 2.5%, but it has slipped to sixth for DJIA and S&P 500 since 1950. Midterm January’s have a troublesome record with average losses for DJIA, S&P 500, NASDAQ, Russell 1000 & 2000. The Santa Claus Rally ends on January 3rd and the First Five Days “Early-Warning” System ends on the 8th. Both indicators provide an early indication of what to expect in 2018. However, I will wait until the official results of the January Barometer on January 31 before tweaking my 2018 Annual Forecast.

Psychological:

Psychological:

Frothy. Bullish sentiment is running near multi-decade highs according to Investor’s Intelligence Advisors Sentiment survey. It’s the holidays, the market is rising and tax reform is on its way to the President’s desk. Traders and investors should be in “good” spirits.

Fundamental:

Fundamental:

Accelerating. Fourth quarter U.S. GDP is currently forecast at 3.3% by the Atlanta Fed’s GDPNow model and the labor market remains firm with 228,000 net new jobs added in November. These may not be the greatest numbers in history, but they are some of the best in many years. Now add on the potential positive impacts of tax reform and reduced regulation. There seems to be more than sufficient fuel to keep the bull market alive and well.

Technical:

Technical:

Overbought. With the exception of Russell 2000, Stochastic, relative strength and MACD indicators applied to DJIA, S&P 500 and NASDAQ are at or near overbought levels. Recently, similar situations were followed by brief periods of sideways (to slightly lower) trading before the next leg higher occurred. Considering the underlying momentum in the market, this will likely be the case this time around; any weakness could be considered an opportunity to add to existing long positions or to establish new positions.

Monetary:

Monetary:

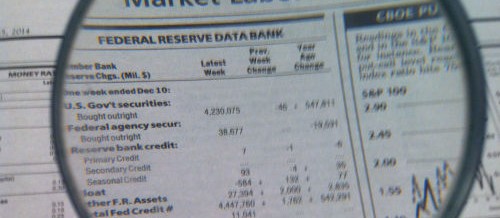

1.25-1.50%. Just as widely expected, the Fed did raise rates at this month’s meeting. Even at the high end of the new range of Fed funds, the rate is still highly supportive of growth and continued firming of the labor market. The Fed’s next meeting ends on January 31 and as of today, CME Group’s FedWatch Tool is showing just a 2.1% probability of another rate increase in January.

JAN

2018