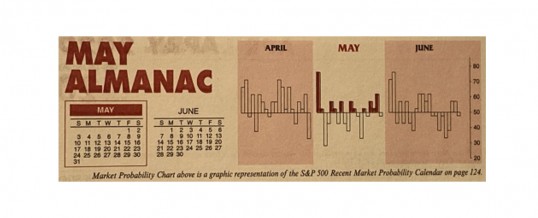

Seasonal:

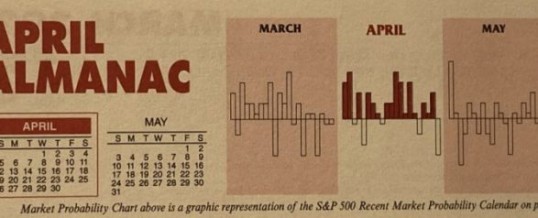

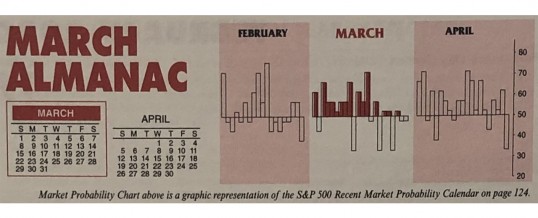

Seasonal:

Neutral. May is the first month of DJIA and S&P 500 “Worst Six Months. Our Seasonal MACD Sell signal has not triggered yet suggesting the rally could continue in the near-term. The history of “Worst Six Months” after a bad “Best Months” is not encouraging. This year’s negative January Barometer and breached December DJIA low, point to possible retest ...

Continue Reading →MAY

2020