Seasonal:

Seasonal:

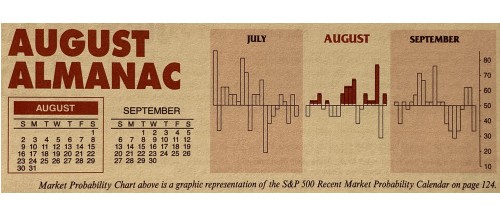

Neutral. August has been the worst DJIA, S&P 500 and NASDAQ month of the year since 1988. However, August’s track record in election years since 1950 (DJIA & S&P 500) or 1971 (NASDAQ) is much better. Average election year August performance ranges from 0.7% by DJIA to 3.3% for Russell 2000 (since 1979). This election year could be different since the ...

Continue Reading →AUG

2020