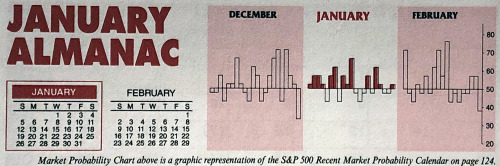

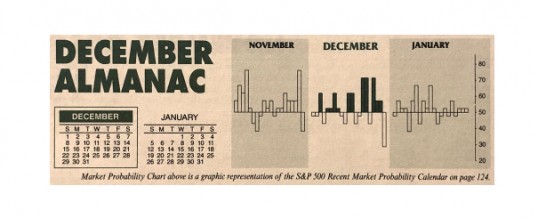

February is notoriously the weak link in “Best Six Months” so we expect the big run the market has been on since mid-October to at least take a breather in February as it often does to consolidate January gains and the gains over the first half of the “Best Six Months.” The market is also digesting a copious and volatile news flow, still elevated valuations and some consolidating technical readings.

Since our October 11, 2019 “Best Six/Eight Months” buy signal, as ...

Continue Reading →FEB

2020