The House of Representatives impeached President Trump December 18, but is holding off sending the articles of impeachment to the Senate until they define the rules of engagement for the Senate trial. Meanwhile the stock market rallied to new all-time highs across the board. Senate republican leadership has made it clear they are not on a trajectory to remove the president from office. The market remains sanguine as the likelihood of the president’s removal from office appears low. So we have sitting president running for reelection with mountains of cash, and an apparently reunified Republican Party rallying around the president.

The day after the impeachment the House passed Trump’s USMCA trade agreement between the USA, Mexico and Canada. Ratification of the USMCA is pending approval of the U.S. Senate and Canadian Parliament in 2020. Across the pond Boris Johnson recently won the latest general election handily, so the UK finally appears headed toward the long awaited smooth and soft Brexit by January 31. Trade is improving with the Phase 1 trade deal with China nearing completion as both China the US have been announcing concessions and details.

The Fed is on hold, but ready to act and already has QE lite underway as it keeps the treasury repo markets flush with liquidity. Weak earnings and high valuations represent the best reason for a mild pullback, mid-January perhaps or just ahead of next earnings season. Risks remain, mostly on the trade and earnings/valuation fronts, but uncertainty appears to be trending lower. Growth is soft, but not zero or negative. Trade deals are moving forward and we have an easy Fed ready to act. Declining uncertainty supports a bullish outlook for 2020.

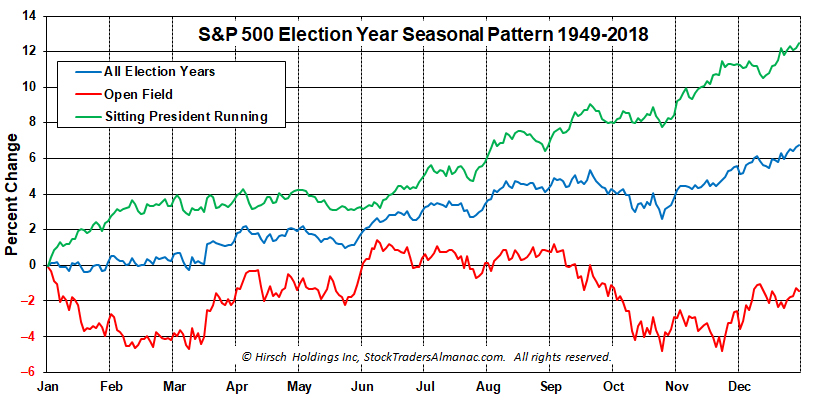

Election Years are generally positive years with the S&P 500 gaining 6.7% on average, but much stronger when a sitting president is running for reelection averaging 12.5% vs. a loss of -1.5% when no sitting president is running.

Four Horseman of the Economy

DJIA along with S&P 500 and NASDAQ have been leading the pack all year long. We have just logged new highs in prototypical Pre-Election Year fashion. Save any major setbacks on the trade, earnings, election or geopolitical fronts gains are likely to trend higher, except for a mild correction.

Consumer confidence remains positive though it has been flattening out over the past five years. Continuing progress on trade deals and Brexit, plus an easy Fed and more stable and functional federal government should help to improve consumer confidence in 2020.

The Unemployment Rate continues to remain super low at 3.5%. Economic activity may have decelerated some, but it remains solid and prices remain stable. Even more jobs are on the near-term horizon as Census 2020 hiring and 2020 election campaign hiring ramps up. We have seen the mailings for how to apply for a census job.

Our inflation horseman as measured by our 6-month exponential moving average calculations on the CPI and PPI have been in retreat, especially the PPI which has gone negative – likely the underlying reason the Fed lowered rates three times this year. CPI is now below the Fed’s target inflation rate of 2% at 1.88%.If negative PPI trickles into CPI we would not be surprised if Fed cut rates again. The Fed is terrified of sub 2% inflation. But with all the government hiring and deficit spending we don’t see a recession likely in 2020.

2020 Forecast

• Worst Case – Correction, but no bear in 2020. Flat to single digit loss for full year due to on-going unresolved trade deals, no improvement in earnings and growth weakens further. Trump is removed from office by the Senate, resigns or does not run and political uncertainty spikes.

• Base Case – Average election year gains. Incumbent victory, trade and growth remain muddled, modest improvement in corporate earnings and Fed stays neutral to accommodative. 5-10% gains for DJIA, S&P 500 and NASDAQ.

• Best Case – Above average gains. Incumbent victory, trade resolved, growth improves, earnings improve and Fed stays neutral and accommodative. 7-12% for DJIA, 12-17% for S&P 500 and 17-25% for NASDAQ.

We will be keeping you fully abreast of all readings from our three January Trifecta Indicators: Santa Claus Rally, First Five Days and the full-month January Barometer and will make adjustments on the close of January 2020.

Happy New Year, we wish you all a healthy and prosperous 2020!

JAN

2020