The Dow Jones Industrial Average suffered its worst one-day point loss on February 27. The market was down all day, but fluctuated dramatically with the headlines. Widespread selling pushed the market into correction territory with the Dow down 12.8% from its February 12 all-time high as of the close on February 27. S&P 500 and NASDAQ are down 12.0% and 12.7% from their respective February 19 all-time highs.

At 8 calendars days long (6 trading days), this is the fastest 10% correction for the S&P 500 from a new all-time high on record. The 1929 2-day crash (DJIA -23.0%), 1987’s 1-day crash (S&P -20.5%) and 2001’s 5-day slide after 9/11 (S&P -11.6%) were faster but not from new highs. Of the 35 previous corrections since 1950, 10 have turned into bears of -20% or more with an average loss of 34.4%. The 25 other corrections averaged a loss of 14.3% and lasted 133 calendar days on average. It was 422 calendar days from the end of the last correction on December 24, 2018 to the recent S&P high on February 19.

Fears of coronavirus spreading rapidly and causing some sort of lasting global supply chain disruption and economic downturn have come at a time of elevated market valuations, seasonal February weakness and the heating up of a contentious presidential election battle.

No matter how you slice it this is disconcerting for the market. But let’s look at the facts we have. This decline has brought elevated valuations and euphoric sentiment down from the recent lofty levels and election cycle patterns remain encouraging. Heightened fear of the virus spreading rapidly here in the U.S. and elsewhere has folks reacting to the headlines without reading further.

For example in this story from the Bay Area CBS affiliate “California Monitoring 8,400 For Coronavirus; Shortage Of Testing Kits Addressed,” if you scroll down a bit and read the details of the story it says, “The California Department of Public Health maintains the risk to the general population in California is low for the coronavirus, and that more than 80% of people infected with the virus have mild or no symptoms.”

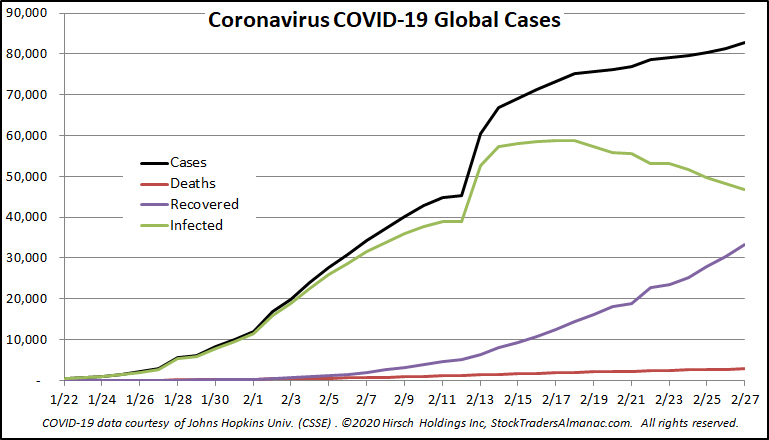

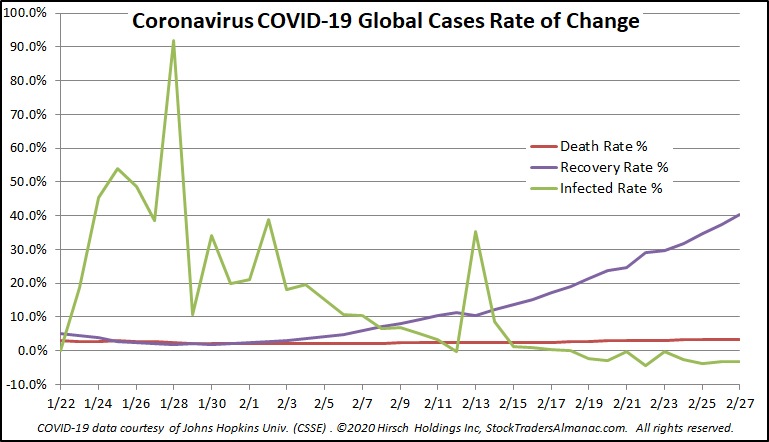

Fear is clearly spreading faster than the virus. Official coronavirus numbers from the best sources we can find show a situation that continues to improve on a global level. Using the data from the excellent interactive web-based dashboard that tracks the Global Cases of Coronavirus COVID-19 created by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University we have created the graphs below.

The rate of new cases per day has decreased from the mid-February spike to 1.7% and the death rate has remained stable with the vast majority on Mainland China. Optimistically, the recovery rate continues to rise and is now at 40.2%. Of the 82,756 global cases at this writing, 2,814 have died, 33,277 have recovered and 46,665 remain infected.

So, while there is still plenty to be concerned about for all of us individually and for health and government officials the numbers we have are improving. In the February 2020 issue we detailed the history of how contagions and outbreaks have impacted the market. Since the coronavirus was confirmed and made public on January 10, 2020 the S&P 500 is down 8.8% at the February 27 close.

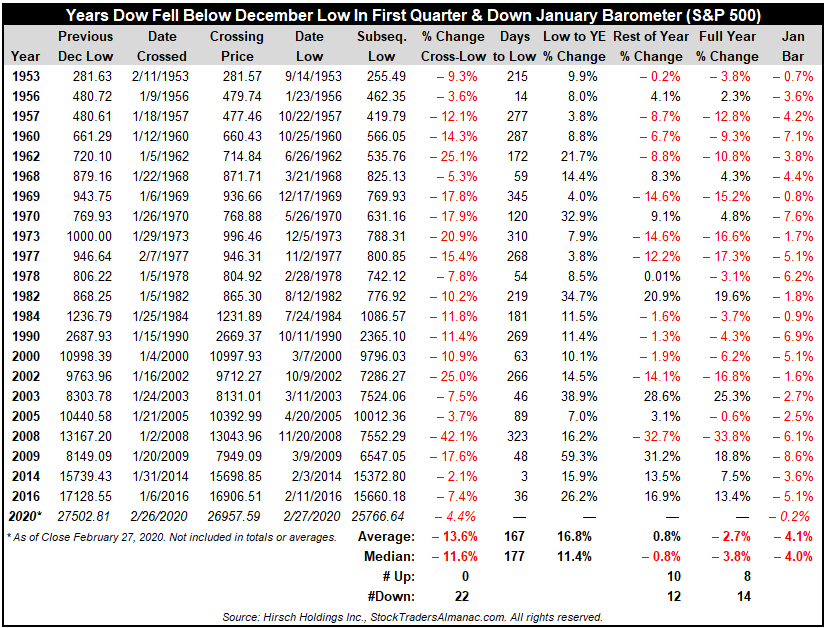

Down January & December Closing Low

Coronavirus has also impacted a couple of our key indicators: the January Barometer (page 22 Stock Trader’s Almanac 2020) and the December Closing Low Indicator (page 34 Stock Trader’s Almanac 2020). January 31’s market decline turned the January Barometer negative as the S&P 500 finished January down 0.2%. This diminished our near-term outlook for the market as every down January since 1950 was followed by a new or continuing bear market, a 10% correction or a flat year.

Heightened coronavirus uncertainties the last week of February knocked the Dow below its December closing low. Years the Dow has closed below its previous December closing low in Q1 the Dow has fallen 10.5% further on average. But in the last 22 occurrences since 1980, 15 of those years have seen gains for the rest of the year averaging 9.7%. Only two years had big hits: 2002 (-14.1, Iraq War) and 2008 (-32.7, Financial Crisis).

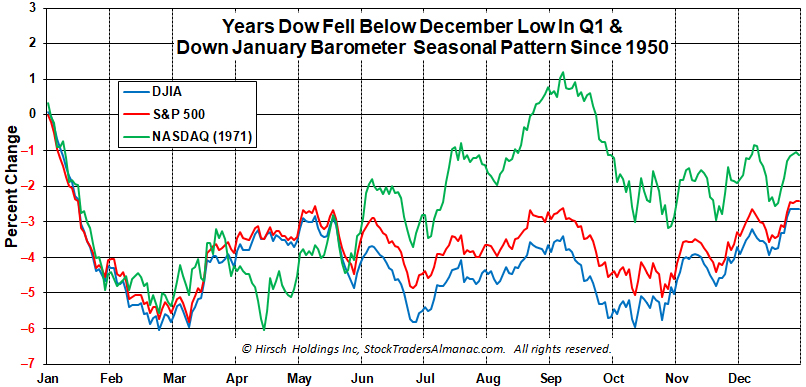

The table below shows the years when both the January Barometer as measured by the S&P 500 were down and the Dow closed below its previous December closing low in the first quarter. We have also created a composite seasonal pattern chart of these 22 years showing how the Dow, S&P 500 and NASDAQ Composite behaved on average in such years.

As you can see from this table and graph most of the negatives of a Down January and a Dow December closing low breach appear to have been satisfied. No one knows what will happen with this virus, but history and the data suggest we have seen the bulk of the worst of the virus and the market decline.

The “Best Six Months” have a 70-year track record and have worked over many timeframes and through crises, exogenous events and all types of markets. Our seasonal and cyclical strategy has also stood the test of time. So stick to the system and remain rational.

MAR

2020