Seasonal:

Seasonal:

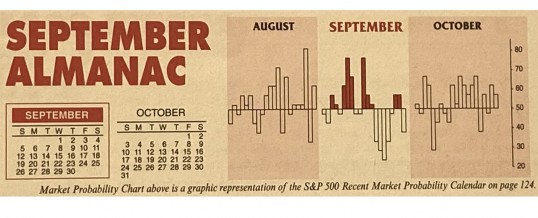

Bearish. September is the worst DJIA, S&P 500, NASDAQ, Russell 1000 and Russell 2000 month. Average declines range from –0.4% from Russell 2000 to –0.7% by DJIA. In post-election years since 1950, September is still ranked no higher than #9 while average performance remains negative with only a modest improvement.

Continue Reading →

31

Continue Reading →

31

AUG

2021

0

AUG

2021