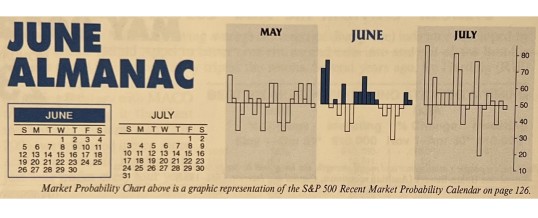

Over the last 51 years June has shone brighter on NASDAQ stocks as a rule ranking fifth best with a 1.0% average gain, up 29 of 51 years. This contributes to NASDAQ’s “Best Eight Months” which ends in June. June ranks near the bottom on the Dow Jones Industrials just above September since 1950 with an average loss of 0.2%. S&P 500 performs similarly poorly, ranking ninth, but essentially flat (0.1% average gain). Small caps also tend to fare well ...

Continue Reading →JUN

2022