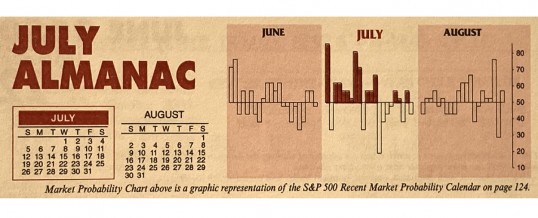

Seasonal:

Seasonal:

Bullish. March is normally a decent performing market month however post-election year payments to the Piper can take a toll on March as average historical gains are trimmed noticeably. In post-election years March ranks: #8 DJIA, S&P 500, and Russell 2000; NASDAQ is 4th worst with an average loss of 0.2%.

Continue Reading →

4

Continue Reading →

4

MAR

2021

0

MAR

2021