In our 2022 Annual Forecast last month we were candid about our less than sanguine outlook for 2022 and that we were expecting a reversion to the mean in annual returns and a decent correction. We shared the many obstacles and hurdles we felt the market would be facing in 2022. First and foremost are the forces of the 4-Year Cycle and the impact the midterm elections have on the market.

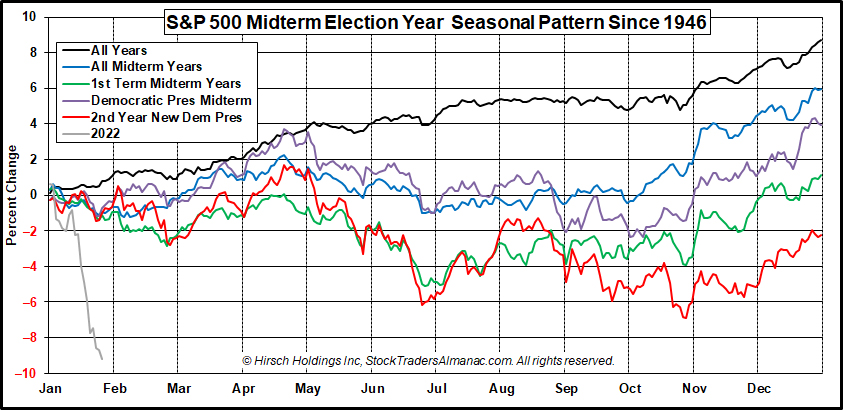

Midterm election years are notoriously volatile as the two political parties battle it out with the opposing party hammering the incumbent president publically, politically and legislatively to control Congress. And this is particularly pronounced for first term presidents like Joe Biden. We have added 2022 year-to-date performance to our chart here of the “S&P 500 Midterm Election Year Seasonal Pattern” and it’s not pretty.

The market has already exceeded the average midterm low this year. But we might find some solace from the table on page 34 in the 2022 Almanac on “Why A 50% Gain in the Dow Is Possible from Its 2022 Low to Its 2023 High.” In the table on that page you will note that of the 27 midterm lows since 1914 the month with the most midterm year lows is January with six. That’s not to say we believe the low for the year is in as the midterm low as you can see in the chart usually comes during the weak spot of the 4-Year Cycle during Q2 or Q3.

Selling Climax Finding Support

The current volatile selloff is disconcerting for the market with several technical support levels already having been breached and support near the October 2021 low around the S&P 500 4300-level currently under attack. Interestingly though, the old stodgy DJIA has been holding up best finding some support for now around 34000. DJIA has not closed below its December closing low of 34022.04 reached on December 1, which means the “December Low Indicator” (2022 Almanac page 36) has not been triggered.

Technical damage has been done, with the major averages breaking through the old uptrend line from the October 2020 low, falling below their 200-day moving averages and now finding resistance at those 200-DMA levels. But we may have seen an Advance/Decline Ratio Selling Climax when more than 70% of total issues traded declined on January 18 and 21 with less than 20% advancing. If the market can find some support here at least in the short-term we could see the market rally into the end of the Best Six Months in April.

But in our opinion, the market still faces obstacles beyond the adverse midterm year forces and the technical breakdown. Geopolitically, pressures have not abated as the situation with Russia and Ukraine remains fluid and the diplomatic dance with China on Taiwan and other fronts continues as well as the usual hot button issues in the Mideast and with North Korea. Rich valuations have come down a bit but they are still elevated. Corporations will have difficulty beating last year’s results with 2021 year-over-year comparisons being a hard act to follow in 2022. Then there is inflation and the Fed shifting from its longtime extremely accommodative stance to a neutral/tightening bias.

And of course there are the discouraging results from our January Indicator Trifecta. The Trifecta started the year on a positive note with the Santa Claus Rally (SCR) coming in with a gain on the second trading day of the year. But that was quickly squashed as the S&P 500 declined for the First Five Days (FFD) of January. And with only two trading days left in January it is highly unlikely our January Barometer (JB) will be positive. S&P 500 would need to rally 10.2% or 439.68 points to overtake the 2021 close of 4766.18 – a tall order indeed. Years when SCR was up but the FFD and the JB were down were not bullish. Only one of the eight occurrences (2014) saw full year gains. A Down January is not a positive indication for the year (2022 Almanac page 22).

But in our opinion, there are some potential positives. The economy is booming with the full-year 2021 GDP number the best reading in three decades since we came out of the double dip recession in 1984. And while we believe the market is suffering from Fed phobia we expect the Fed to be in no rush to quell inflation with a major tightening cycle. They have not been in any hurry up to now so why would they suddenly speed up. They will most likely remain data dependent and maintain their wait-and-see attitude. We expect 4 rate hikes this year and for them to occur at the FOMC meetings associated with their Summary of Economic Projections in March, June, September and December. But most importantly, even after the anticipated increases, rates will remain historically low.

All in all we expect the market to find support here in February and then rally back toward the recent highs by the end of the Best Six Months in April. After that we expect a retest of the current lows and perhaps lower lows in the Worst Six Months of 2022, the weak spot of the 4-Year Cycle, followed by a Q4 rally at the beginning of the sweet spot of the 4-Year Cycle in line with our 2022 Annual Forecast Base Case Scenario with S&P 500 and DJIA finishing 2022 up 5-10% and NASDAQ slightly weaker.

FEB

2022