Seasonal:

Seasonal:

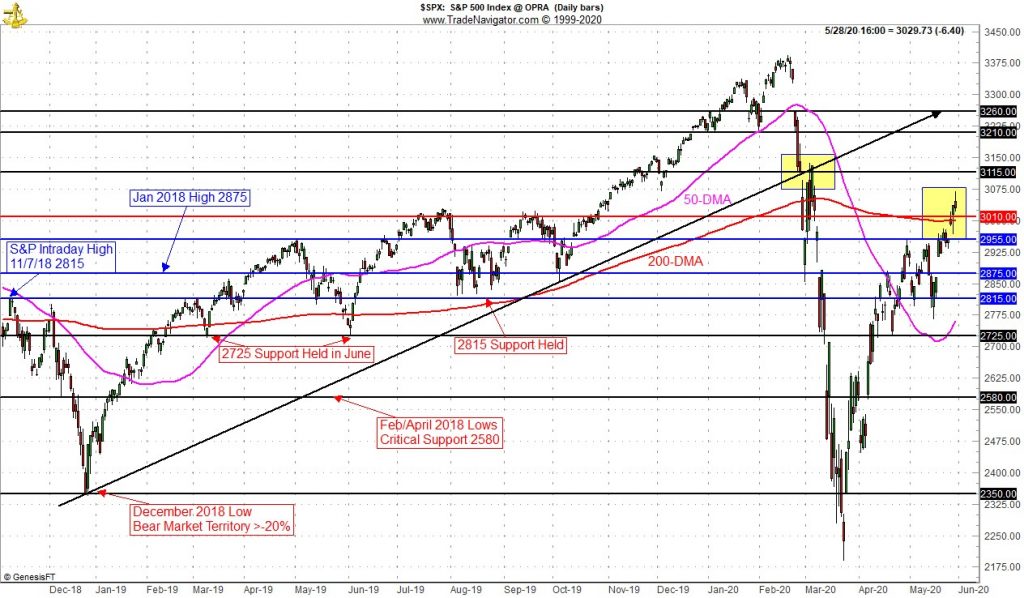

Improving. October is the last month of the “Worst Six Months” for DJIA and S&P 500 and the last month of NASDAQ’s “Worst Four Months”. In election years, October ranks dead last, but excluding October 2008, ranking improves to mid-pack. Our Official MACD Seasonal Buy Signal can trigger anytime on or after October 1.

Continue Reading →

2

Continue Reading →

2

OCT

2020

0

OCT

2020