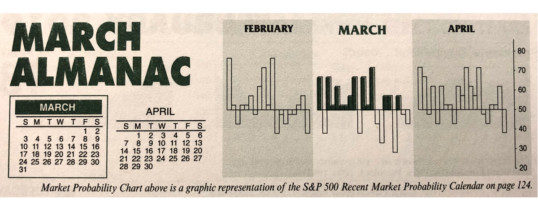

Seasonal:

Seasonal:

Bearish. 1950, September is the worst performing month of the year for DJIA, S&P 500, and NASDAQ (since 1971). In pre-election years, rankings are unchanged while average losses expand.

Psychological:

Psychological:

Fading. According to Investor’s Intelligence Advisors Sentiment survey, bulls are ...

Continue Reading →SEP

2019