Seasonal:

Seasonal:

Neutral. May officially marks the beginning of the “Worst Six Months” for the DJIA and S&P. To wit: “Sell in May and go away.” But NASDAQ’s “Best Eight Months” last until June. In pre-election years, May can be challenging ranking #10 for DJIA and S&P 500 with fractional average gains. NASDAQ has been stronger, ranking #7 with an average advance of 1.9%.

Psychological:

Psychological:

Skeptical. According to Investor’s Intelligence Advisors Sentiment survey bulls are at 56.4%. Correction advisors are at 25.8% and Bearish advisors are 17.8%. Bullish advisors have exceeded 50% for eleven weeks straight now. However, there remain a sizeable number of advisors expecting a correction. This suggests there is just enough caution in place for the market to slowly make its way higher. Whether or not major indexes can make and hold new highs is the key point in the bull/bear debate now.

Fundamental:

Fundamental:

Reasonably firm. Q1 2019 GDP advanced estimate came in ahead of expectations at 3.2%. The last Atlanta Fed GDPNow estimate on April 25 the day before the GDP release was 2.7%. This is a significant improvement over the 1.5% that was forecast about a month ago. Unemployment is still 3.8% after the economy added 196,000 jobs in March. Initial weekly jobless claims did spike higher than expected but may have been influenced by Good Friday and Easter. Earnings have been mixed. Mega-cap technology remains strong while industrials appear stuck in the mud. The overall outlook is still positive with modest growth, low inflation and relatively low interest rates.

Technical:

Technical:

Breaking Out? S&P 500 and NASDAQ have logged new all-time highs. DJIA came within 150 points at its recent April 23 high. Only time will time if this was just a double top or the beginning of the next leg of a rally. As long as the outlook for the second half of 2019 and beyond continues to improve, then a period of consolidation is likely followed by further gains into yearend and possibly beyond.

Monetary:

Monetary:

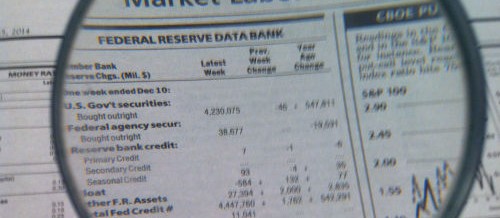

2.25-2.50%. Partial yield curve inversion and cooling growth estimates have put the Fed on hold. Rates are not likely to move until economic data justifies it. Higher rates are a possibility, just not that high of a probability with CME Group’s FedWatch Tool currently forecasting a 61.7% chance of a rate cut at the January 2020 Fed meeting. The Fed’s next meeting at the end of April is likely to be another quiet one.

MAY

2019