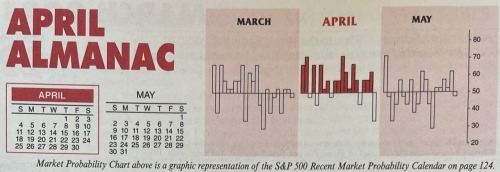

April marks the end of the “Best Six Months” for DJIA and the S&P 500. The window for our seasonal MACD sell signal opens on April 1st. From our Seasonal MACD Buy Signal on November 5, 2020 through the close on March 25, 2021, DJIA was up 14.9% and S&P 500 had advanced 11.4%. These above average gains are encouraging and suggest seasonality is back on track after getting derailed by Covid-19 last year.

April 1999 was the first month to ...

Continue Reading →MAR

2021