Seasonal:

Seasonal:

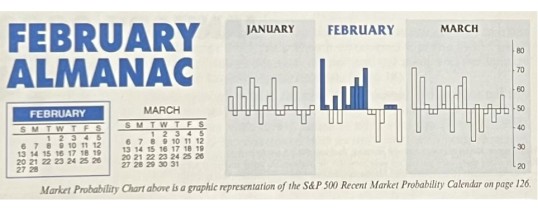

Neutral. February is part of the “Best Six Months,” but it is historically the poorest performing month of the six. February ranks #8 for DJIA, #11 S&P 500 and #10 for NASDAQ. Russell 2000 tends to outperform in February most likely due to carry over of the January Effect. Midterm Februarys have historically been better, but still only mid-pack for DJIA ...

Continue Reading →FEB

2022