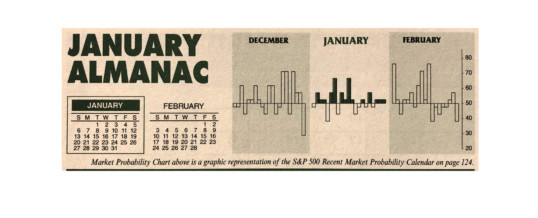

The Dow posted a 7.2% gain for the month of January – not only its best monthly gain in the past three months, but its best January since 1989. S&P 500 outpaced the Dow with a 7.9% gain for the month – its best January since 1987, scoring our third January Indicator Trifecta in a row. Further details on the bullish implications of the January Indicator Trifecta can be seen here “January Barometer 2019 Official Results.”

NASDAQ stocks ...

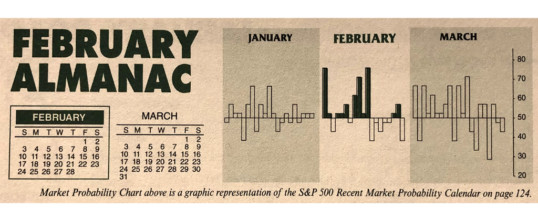

Continue Reading →FEB

2019