So far our June 21 NASDAQ Best 8 Months Sell Signal has turned out to be rather timely. From our November 28 Buy Signal to our June 21 Sell Signal NASDAQ gained 11.6%. NASDAQ has given back sizeable ground since June 21. The Dow and S&P 500 have been in selloff mode a bit longer since June 13.

We have been getting on the defensive since our May 2 Dow and S&P 500 Best Six Months Sell signal and it now looks like seasonal and geopolitical pressures are beginning to take a toll on the market.

As June and Q2 come to a close stocks are trying to mount a rally and July is the best month of the third quarter. It remains to be seen if NASDAQ’s perennial mid-year rally can materialize and lift all stocks. But if it does it will provide ample opportunity to unload underperforming and unwanted positions and firm up your summer portfolio defense.

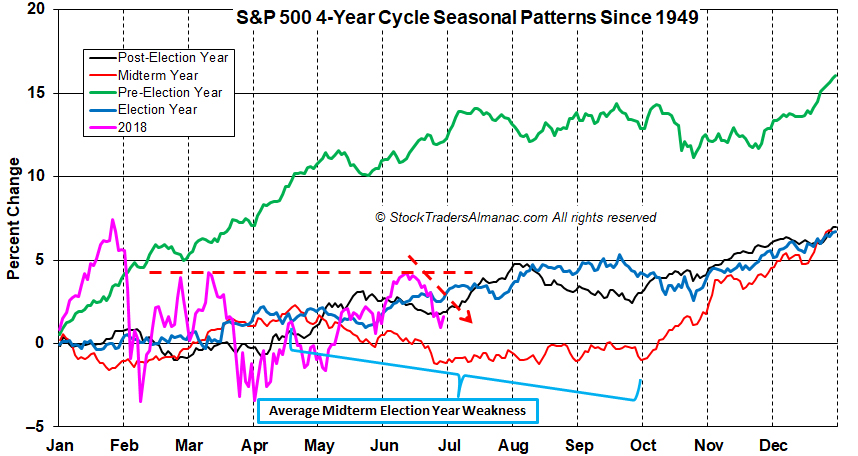

You can see in the updated chart below of the S&P 500 4-Year Cycle Seasonal Patterns that the blue chip index failed at resistance (red-dotted line) and did not clear the March highs. We are solidly in risk off mode. The Best Months are over, summer is worse in midterm years and the rhetoric and developments in the geopolitical arena are conspiring to spook the market.

GE’s boot from the Dow doesn’t seem to be helping matters either. And as we enter deeper into the bearish season several matters could jolt market. Trump’s scheduled tête-à-tête with Putin and the ongoing trade and tariff battles are bound to give markets a scare. Then there is the pressure of rising oil prices and the sudden bout of cold feet we are hearing from the Fed as inflation begins to percolate. High market valuations may be succumbing to bearish seasonality and midterm politicking as the market is on the brink of a technical breakdown through support.

So, stick to the drill and keep your powder dry. Raise some cash. Continue to weed out losing or lagging positions, pick up some more defensive holdings and wait for that fatter pitch we anticipate later in Q3 or early Q4 as we hit the sweet spot of the 4-Year Cycle.

JUL

2018