Seasonal:

Seasonal:

Bullish. April is the best DJIA month since 1950, third best for S&P and fourth best for NASDAQ (since 1971). However, typical midterm-election year woes have historically tempered April’s performance. April is also the last month of the “Best Six Months.”

Psychological:

Psychological:

Disbelief. For all the volatility the market has exhibited over the past two months, bullish sentiment is still elevated. According to Investor’s Intelligence Advisors Sentiment survey bulls are at 49.5% and correction advisors stand at 33%. Bearish advisors remain scarce at 17.5%. Further declines in bullish sentiment would be a welcome sign as negative sentiment is usually strongest near bottoms.

Fundamental:

Fundamental:

Firm. Unemployment remains low and corporate earnings forecasts remain firm. Q1 GDP estimates have cooled and the Atlanta Fed GDPNow model is currently forecasting 2.4% for the quarter. Tariffs have the potential to dampen global activity, but thus far it looks more like a negotiating tactic rather than an actual major shift in policy. Numerous exceptions have already been given for the steel and aluminum tariffs mitigating their full impact and likely setting the precedent for any future tariffs.

Technical:

Technical:

Bouncing. March’s second-half selloff appears to have found support around 200-day moving averages (DMA). S&P 500 was closest to its 200-DMA. DJIA and NASDAQ declines paused just above their respective 200-DMA. Technical indicators are in or very near oversold territory. If headline news risk abates, the stage is set for a near-term bounce. Whether or not the bounce becomes a sustainable rally will largely depend upon early Q1 earnings results and accompanying Q2 and beyond guidance.

Monetary:

Monetary:

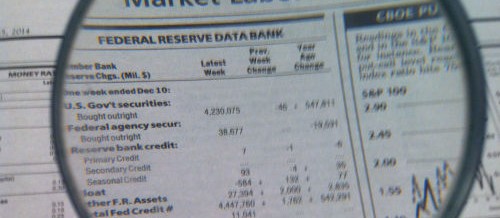

1.50-1.75%. The Fed did exactly what was widely anticipated when its March meeting ended, they raised rates 0.25%. Rates are still expected to go higher later this year, but the Fed remains data dependent. The pace of future increases will largely depend upon inflation and growth data and expectations. In the meantime, longer-term rates are still low within a historical context.

MAR

2018