The Probabilities Fund seeks capital appreciation by systematically investing to gain long, short or leveraged exposure primarily to the S&P 500 through Index ETFs. The strategy employs a systematic approach utilizing seasonal trends and patterns that have historically had a statistically significant impact on stock market returns. The strategy’s historically low correlation may provide diversification benefits to traditional portfolio allocations. There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses.

Category: Liquid Alternative - Class A: PROTX Class C: PROCX

Strategy Highlights

People:

- Thought leadership in the trend following space.

- Over 100 years cumulative experience.

Philosophy:

- Be out of the market during periods when there is a high probability of downside risk.

- Be in the market during periods when there is a high probability of upside reward.

Process:

Utilizing index based ETFs to obtain dynamic exposure to the US stock market.

- Long 1X – approximately 45% of the time.

- Cash – approximately 30% of the time.

- Leveraged – approximately 20% of the time.

- Short – approximately 5% of the time.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. The total annual fund operating expenses are Class A 2.43%, Class C 3.18% and Class I 2.18%. The Fund’s advisor has contractually agreed to reduce the fees and/or absorb expenses of the Fund, at least until January 31, 2018, to ensure that the net annual fund operating expenses will not exceed 2.14% for Class A, 2.89% for Class C and 1.89% for Class I, subject to possible recoupment from the Fund in future years. The maximum sale charge for Class A shares is 5.75%. For performance information current to the most recent month-end, please call toll-free 800-519-0438 or visit our website, www.probabilitiesfund.com.

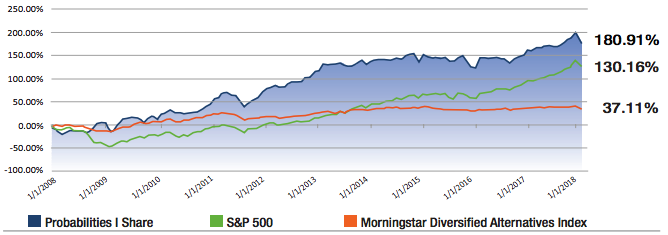

Cumulative Growth Chart

Past Performance is no indication of future returns. Since inception, January 1, 2008 to present. The Morningstar Diversified Alternatives Index is comprised of seven alternative asset classes that broadly represent the alternative landscape, hedge funds, long/short equity, merger arbitrage, managed futures, breakeven Inflation, global Infrastructure, and listed private equity. The hypothetical scenario does not take into account federal, state or municipal takes. If taxes were taken into account, the hypothetical values shown would have been lower.

Statistical Analysis vs S&P 500

| Probabilities I Share | MDAI | S&P 500 | |

| Cumulative Performance | 180.91% | 37.11% | 130.16% |

| Annualized Alpha | 6.84% | -0.23% | 0.00% |

| Beta | 0.50 | 0.35 | 1.00 |

| Sharpe Ratio | 0.69 | 0.45 | 0.59 |

| Standard Deviation | 15.98% | 6.53% | 15.10% |

| Maximum Drawdown | -22.29% | -15.25% | -48.45% |

| Correlation | 0.47 | 0.81 | 1.00 |

| Up Capture of S&P 500 | 81.08% | 37.02% | 100% |

| Down Capture of S&P 500 | 60.13% | 37.61% | 100% |

Trailing Returns

As of 2/28/2018 (Greater than one year, annualized)

| YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | |

| Probabilities Fund I Share (Inception 01/01/2008) | -2.38% | 7.51% | 3.60% | 5.36% | 12.55% | 10.70% |

| Probabilities Fund A at NAV (Inception 01/16/2014) | -2.41% | 7.29% | 3.35% | N/A | N/A | 3.68% |

| Probabilities Fund A at Maximum Load | -8.03% | 1.09% | 1.32% | N/A | N/A | 2.20% |

| Probabilities Fund C (Inception 01/16/2014) | -2.59% | 6.52% | 2.60% | N/A | N/A | 2.90% |

| S&P 500 Total Return | 1.83% | 17.10% | 11.14% | 14.73% | 9.73% | 8.55% |

Standardized Returns

As of 12/31/2017 (Greater than one year, annualized)

| Updated Quarterly | YTD | 1 Year | 3 Years | 5 Years | Since Inception |

| Probabilities Fund I Share (Inception 01/01/2008) | 16.03% | 16.03% | 4.25% | 7.21% | 11.15% |

| Probabilities Fund A at NAV (Inception 01/16/2014) | 15.77% | 15.77% | 4.00% | N/A | 4.47% |

| Probabilities Fund A at Maximum Load | 9.14% | 9.14% | 1.96% | N/A | 2.92% |

| Probabilities Fund C (Inception 01/16/2014) | 14.95% | 14.95% | 3.24% | N/A | 3.71% |

| S&P 500 Total Return | 21.83% | 21.83% | 11.41% | 15.79% | 8.50% |

Historical Performance (PROTX)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | MDAI* | S&P 500 | ITD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018 | 4.40% | -6.50% | -2.38% | -1.61% | 1.83% | 180.91% | ||||||||||

| 2017 | 1.05% | 4.26% | -0.27% | 2.27% | 0.18% | 0.98% | 0.79% | -0.61% | 0.26% | 1.84% | 2.67% | 1.65% | 16.03% | 2.70% | 21.83% | 187.76% |

| 2016 | -6.02% | -1.36% | 9.89% | 0.19% | -0.48% | 0.78% | 0.10% | -1.64% | -0.39% | -2.85% | 3.74% | 1.95% | 3.16% | 2.31% | 11.96% | 148.01% |

| 2015 | -7.56% | 7.58% | -1.95% | -1.14% | 0.29% | -0.95% | 1.35% | -3.61% | 0.39% | 3.83% | 1.04% | -3.93% | -5.35% | -3.66% | 1.38% | 140.42% |

| 2014 | -4.46% | 2.98% | 1.35% | 0.19% | 0.10% | -0.47% | 0.00% | 1.62% | -0.66% | 2.27% | 1.85% | 0.61% | 5.30% | 3.04% | 13.69% | 154.02% |

| 2013 | 5.91% | 0.53% | 6.57% | -0.24% | 0.62% | 0.28% | 0.71% | -2.23% | -0.35% | 0.71% | 2.53% | 2.61% | 18.73% | 8.64% | 32.39% | 141.29% |

| 2012 | 6.19% | 5.83% | 2.04% | 2.38% | -2.80% | 0.18% | 4.19% | 1.77% | -0.26% | 0.70% | 5.13% | 0.07% | 28.07% | 6.82% | 16.00% | 103.17% |

| 2011 | 4.16% | 7.75% | 2.12% | 6.09% | 0.81% | -3.26% | -0.49% | -8.86% | -6.67% | 5.79% | 4.38% | 2.54% | 13.65% | -3.67% | 2.11% | 58.64% |

| 2010 | -6.75% | 10.41% | 4.41% | 2.16% | -3.56% | 0.62% | -2.97% | 1.22% | 1.70% | 0.62% | 3.09% | 5.45% | 16.43% | 11.83% | 15.06% | 39.48% |

| 2009 | -0.94% | -15.90% | 1.44% | 10.98% | 15.15% | 0.75% | 3.01% | -1.84% | -1.82% | -7.96% | 8.31% | 5.76% | 13.88% | 21.73% | 26.46% | 19.89% |

| 2008 | 1.68% | -15.28% | -8.28% | 5.59% | 6.07% | -0.61% | -0.07% | -2.56% | -2.33% | 10.19% | 11.65% | 2.30% | 5.27% | -12.21% | -37.00% | 5.28% |

Historical Performance (PROTX)

| Jan | Feb | Mar | Apr | May | |

|---|---|---|---|---|---|

| 2018 | 4.40% | -6.50% | |||

| 2017 | 1.05% | 4.26% | -0.27% | 2.27% | 0.18% |

| 2016 | -6.02% | -1.36% | 9.89% | 0.19% | -0.48% |

| 2015 | -7.56% | 7.58% | -1.95% | -1.14% | 0.29% |

| 2014 | -4.46% | 2.98% | 1.35% | 0.19% | 0.10% |

| 2013 | 5.91% | 0.53% | 6.57% | -0.24% | 0.62% |

| 2012 | 6.19% | 5.83% | 2.04% | 2.38% | -2.80% |

| 2011 | 4.16% | 7.75% | 2.12% | 6.09% | 0.81% |

| 2010 | -6.75% | 10.41% | 4.41% | 2.16% | -3.56% |

| 2009 | -0.94% | -15.90% | 1.44% | 10.98% | 15.15% |

| 2008 | 1.68% | -15.28% | -8.28% | 5.59% | 6.07% |

| Jun | Jul | Aug | Sep | Oct | |

|---|---|---|---|---|---|

| 2018 | |||||

| 2017 | 0.98% | 0.79% | -0.61% | 0.26% | 1.84% |

| 2016 | 0.78% | 0.10% | -1.64% | -0.39% | -2.85% |

| 2015 | -0.95% | 1.35% | -3.61% | 0.39% | 3.83% |

| 2014 | -0.47% | 0.00% | 1.62% | -0.66% | 2.27% |

| 2013 | 0.28% | 0.71% | -2.23% | -0.35% | 0.71% |

| 2012 | 0.18% | 4.19% | 1.77% | -0.26% | 0.70% |

| 2011 | -3.26% | -0.49% | -8.86% | -6.67% | 5.79% |

| 2010 | 0.62% | -2.97% | 1.22% | 1.70% | 0.62% |

| 2009 | 0.75% | 3.01% | -1.84% | -1.82% | -7.96% |

| 2008 | -0.61% | -0.07% | -2.56% | -2.33% | 10.19% |

| Nov | Dec | YTD | MDAI* | S&P 500 | ITD | |

|---|---|---|---|---|---|---|

| 2018 | -2.38% | -1.61% | 1.83% | 180.91% | ||

| 2017 | 2.67% | 1.65% | 16.03% | 2.70% | 21.83% | 187.76% |

| 2016 | 3.74% | 1.95% | 3.16% | 2.31% | 11.96% | 148.01% |

| 2015 | 1.04% | -3.93% | -5.35% | -3.66% | 1.38% | 140.42% |

| 2014 | 1.85% | 0.61% | 5.30% | 3.04% | 13.69% | 154.02% |

| 2013 | 2.53% | 2.61% | 18.73% | 8.64% | 32.39% | 141.29% |

| 2012 | 5.13% | 0.07% | 28.07% | 6.82% | 16.00% | 103.17% |

| 2011 | 4.38% | 2.54% | 13.65% | -3.67% | 2.11% | 58.64% |

| 2010 | 3.09% | 5.45% | 16.43% | 11.83% | 15.06% | 39.48% |

| 2009 | 8.31% | 5.76% | 13.88% | 21.73% | 26.46% | 19.89% |

| 2008 | 11.65% | 2.30% | 5.27% | -12.21% | -37.00% | 5.28% |

Important Disclosures

Investors should carefully consider the investment objectives, risks, charges and expenses of the Probabilities Fund. This and other important information about the Fund is contained in the Prospectus, which can be obtained by contacting your financial advisor, or by calling 1.888.868.9501. The Prospectus should be read carefully before investing. Probabilities Fund is distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Probabilities Fund Management, LLC and Northern Lights Distributors are not affiliated.

Performance shown before the inception date of the mutual fund, December 12, 2013, is for the Fund’s predecessor limited partnership. The prior performance is net of management fee and other expenses, including the effect of the performance fee. The Fund’s investment goals, policies, guidelines and restrictions are similar to the predecessor limited partnership. From its inception date, the predecessor limited partnership was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940 which if they had been applicable, it might have adversely affected its performance. In addition, the predecessor limited partnership was not subject to sales loads that would have adversely affected performance. Performance of the predecessor fund is not an indicator of future results.

Mutual Funds involve risk including the possible loss of principal.

ETFs are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, your cost of investing in the Fund will be higher than the cost of investing directly in the ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. Each ETF is subject to specific risks, depending on its investments. Leveraged ETFs employ leverage, which magnifies the changes in the value of the Leveraged ETFs, which could result in significant losses to the Fund. The Fund invests in Leveraged ETFs in an effort to deliver daily performance at twice the rate of the underlying index and if held over long periods of time, particularly in volatile markets, the ETFs may not achieve their objective and may, in fact, perform contrary to expectations.

Inverse ETFs are designed to rise in price when stock prices are falling. Inverse ETFs tend to limit the Fund’s participation in overall market-wide gains. Accordingly, their performance over longer terms can perform very differently than underlying assets and benchmarks, and volatile markets can amplify this effect.

The advisor’s judgment about the attractiveness, value and potential appreciation of particular security or derivative in which the Fund invests or sells short may prove to be incorrect and may not produce the desired results. Equity prices can fall rapidly in response to developments affecting a specific company or industry, or to changing economic, political or market conditions. A higher portfolio turnover may result in higher transactional and brokerage costs. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance does not guaranteed future results. The S&P 500 Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks.

Alpha is a measure of the excess return of a fund over an index. Beta is a measure of a fund’s volatility relative to market movements. Sharpe Ratio is a measure of risk adjusted performance calculated by subtracting the risk-free rate from the rate of return of the portfolio and dividing the result by the standard deviation of the portfolio returns. The 3 month T-Bill rate was used in the calculation.

Standard Deviation is a statistical measurement of volatility risk based on historical returns. Maximum Drawdown represents the largest peak-to-trough decline during a specific period of time. Correlation is a statistical measure of how two investments move in relation to each other.

Up and Down Capture ratios reflect how a particular investment performed when a specific index has either risen or fallen. Long positions entail buying a security such as a stock, commodity or currency, with the expectation that the asset will rise in value. Short positions entail a sale that is completed by the delivery of a security borrowed by the seller. Short sellers assume they will be able to buy the stock at a lower amount that the price at which they sold short.