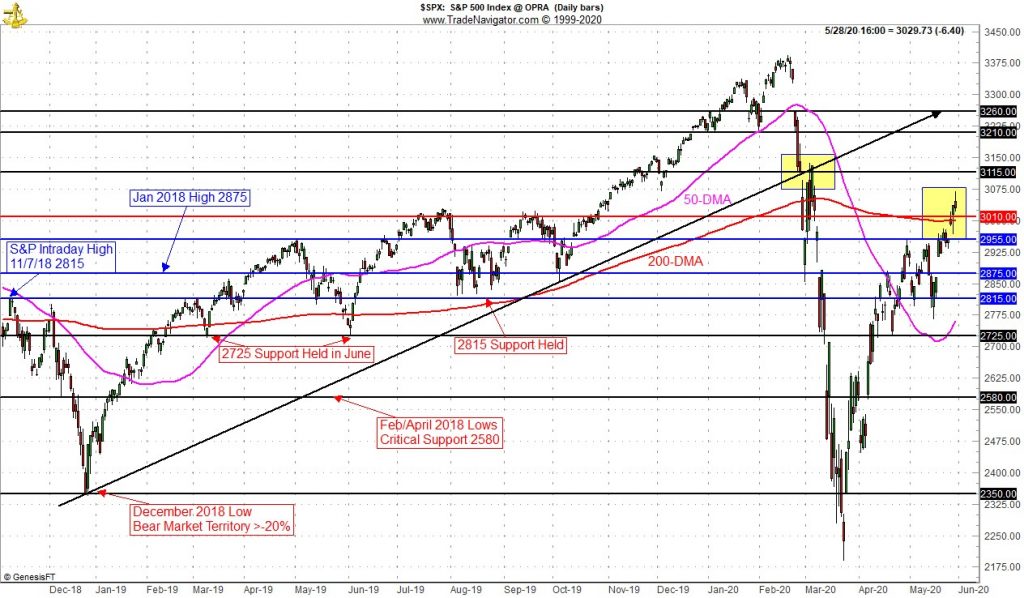

Our Best Six Months Seasonal MACD Sell Signal for DJIA and S&P 500 triggered on May 13 when this recovery rally took a brief pause. The rally then resumed adding to May’s gains and putting NASDAQ back in the black for the year and up 5.8% year-to-date on the close of May. But the market is bumping into some resistance here technically and looks set to pause again and pullback to recent support levels.

JUN

2020