Seasonal:

Seasonal:

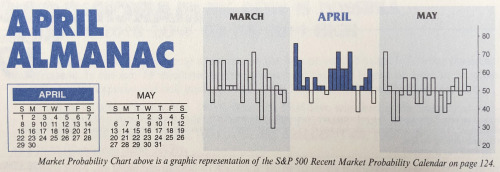

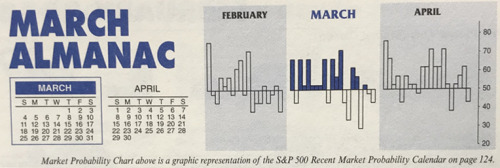

Bullish. April is the best DJIA month since 1950, third best for S&P and fourth best for NASDAQ (since 1971). However, typical midterm-election year woes have historically tempered April’s performance. April is also the last month of the “Best Six Months.”

Psychological:

Psychological:

Disbelief. For ...

Continue Reading →APR

2018