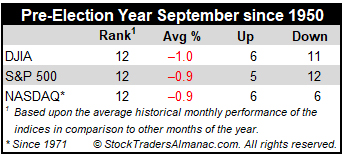

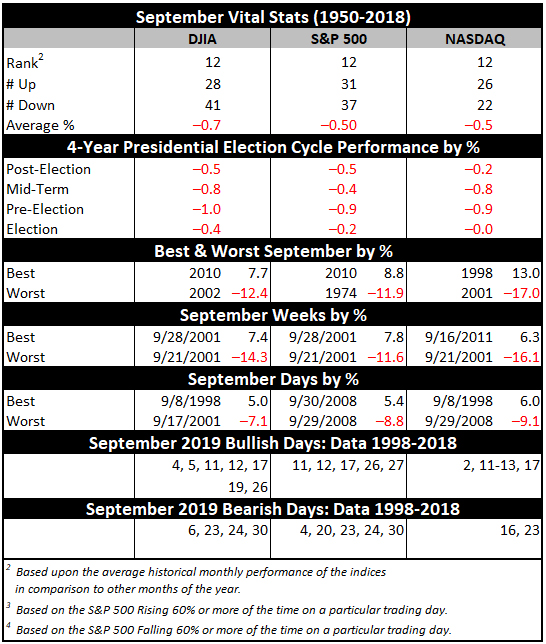

The start of business year, end of summer vacations, and back to school made September a leading barometer month in first 60 years of the 20th century, now portfolio managers back after Labor Day tend to clean house Since 1950, September is the worst performing month of the year for DJIA, S&P 500, and NASDAQ (since 1971). September was creamed four years straight from 1999-2002 after four solid years from 1995-1998 during the dot.com bubble madness. September gets no respite from positive pre-election year forces.

Although the month used to open strong, S&P 500 has declined eight times in the last eleven years on the first trading day. As tans begin to fade and the new school year begins, fund managers tend to sell underperforming positions as the end of the third quarter approaches, causing some nasty selloffs near month-end over the years. Recent substantial declines occurred following the terrorist attacks in 2001 (DJIA: –11.1%), 2002 (DJIA –12.4%), the collapse of Lehman Brothers in 2008 (DJIA: –6.0%) and U.S. debt ceiling debacle in 2011 (DJIA –6.0%). However, September is improving with S&P 500 advancing in ten of the last 15 Septembers and DJIA climbing in nine.

September Triple Witching week is generally bullish with S&P 500 advancing twice as many times as declining since 1990, but is has suffered some sizable losses. Triple-Witching Friday was essentially a sure bet for the bulls from 2004 to 2011 but has been a loser four to six of the last seven years, depending on index. The week after Triple Witching has been brutal, down 23 of the last 29, averaging an S&P 500 loss of 0.95%. In 2011, DJIA and S&P 500 both lost in excess of 6%. The week after was positive in 2016 and 2017.

In recent years, Labor Day has become the unofficial end of summer and the three-day weekend has become prime vacation time for many. Business activity ahead of the holiday was more energetic in the old days. From 1950 through 1977 the three days before Labor Day pushed the DJIA higher in twenty-three of twenty-eight years. Bullishness has since shifted to favor the two days after the holiday as opposed to the days before. DJIA has gained in 16 of the last 25 Tuesdays and 18 of the last 24 Wednesdays following Labor Day.

SEP

2019